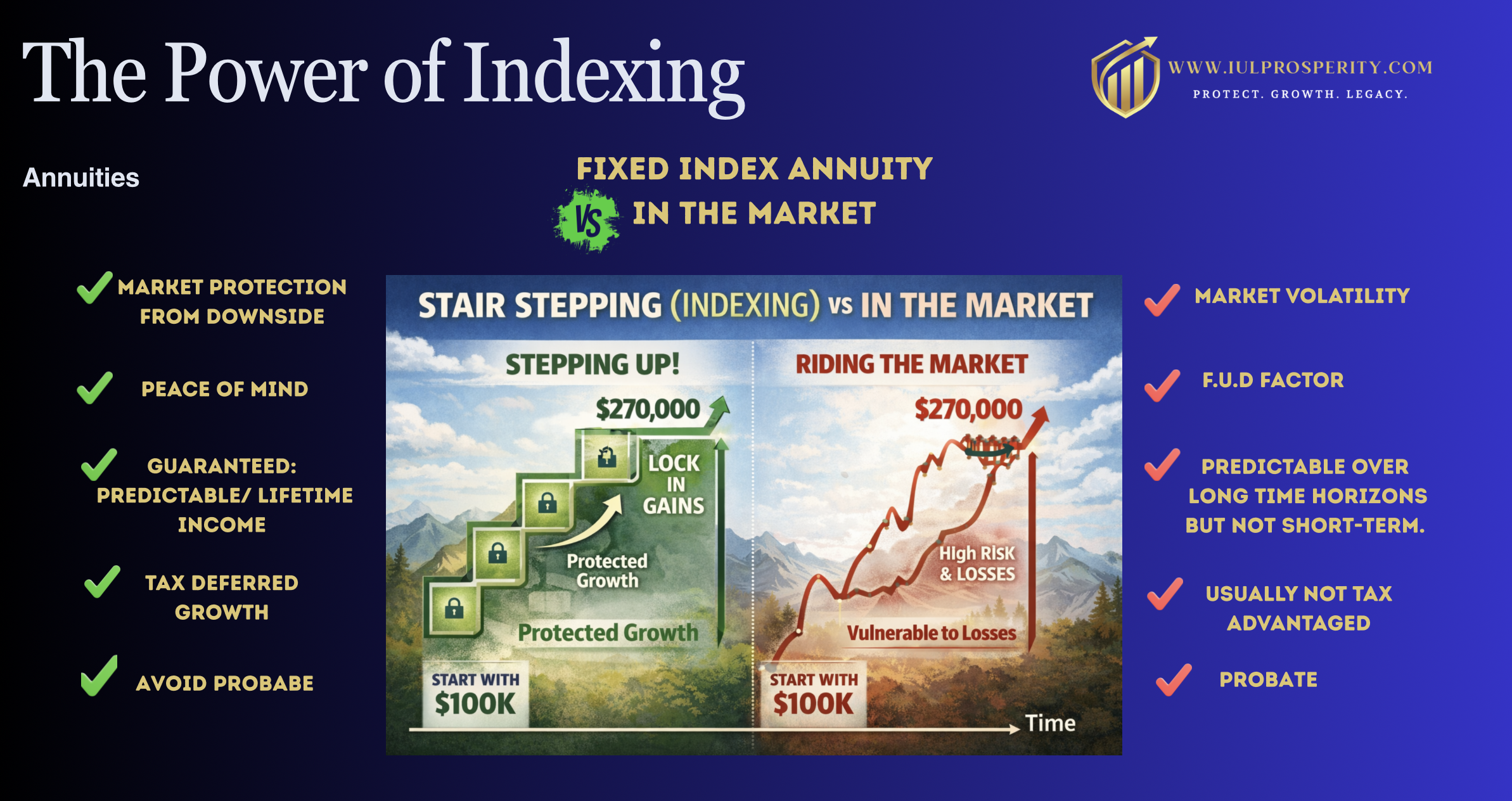

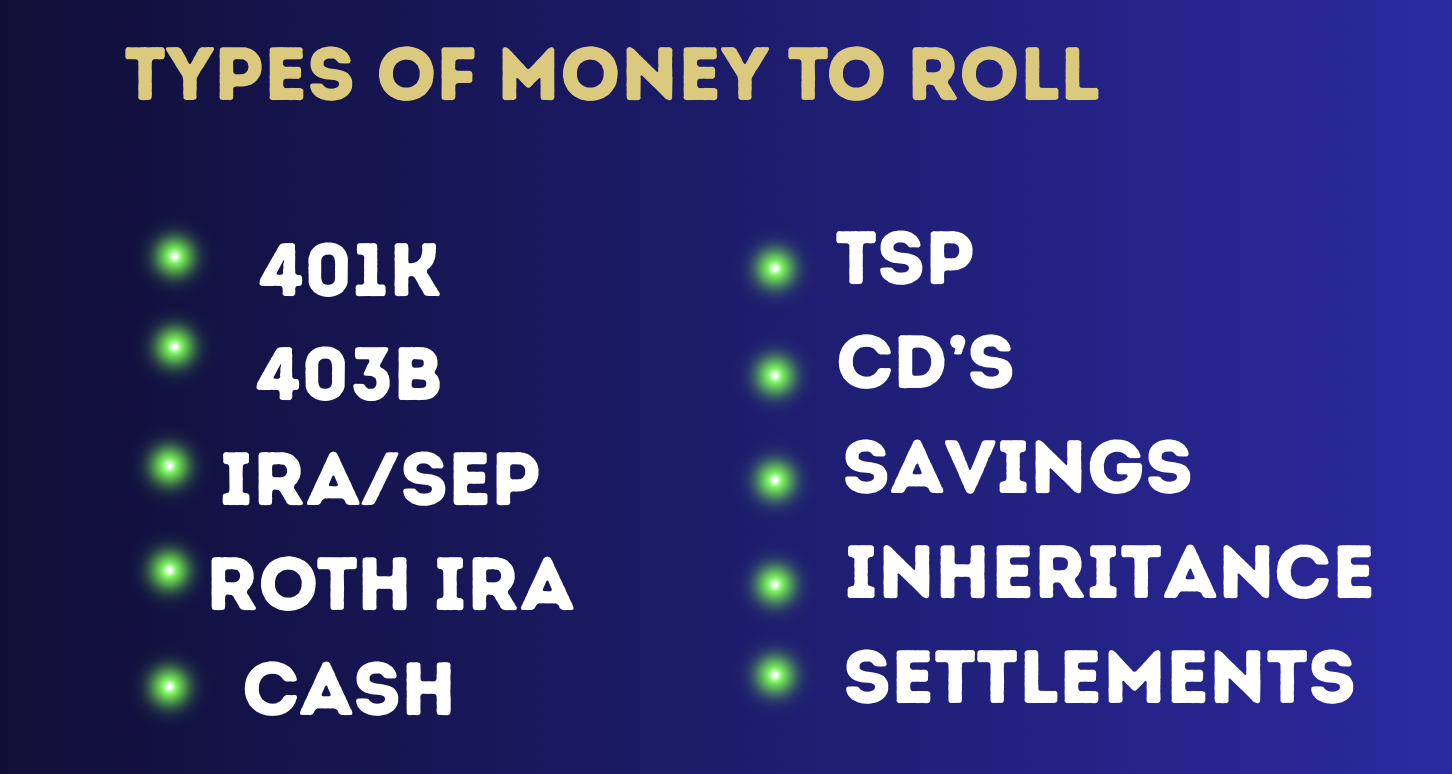

What is a Fixed Income Annuity? A FIA is a contract that transfers market risk to the insurance carrier in exchange for downside protection and predictable income for the annuitant.

Looking 10, 15, or 20 years down the road, what would trouble you more: giving up some potential upside, or living with the uncertainty of whether your income will last and how the next market downturn could affect you?

As you approach retirement and move from accumulation to distribution, making your money last becomes the priority. Income for Life riders help provide guaranteed income for you—or you and your spouse—delivering peace of mind that’s truly priceless.

As an independent marketing organization, we have access to a wide range of insurance carriers, allowing us to match clients with the solutions that best fit their goals. Not all annuities are created equal. Here are three top-performing carriers as we enter 2026.

In the United States, more than $2 trillion is held in annuity assets, underscoring the growing demand for safe, reliable income.

Top 3 Reasons to own an Annuity!

Peace of mind is the real goal of retirement. When you no longer worry about where your income is coming from, you’re free to enjoy life. Research shows retirees with fixed, protected income sources—like FIAs—consistently report higher happiness and less financial stress.

Income you can’t outlive changes everything. FIA income riders can guarantee lifetime payments, even if your policy’s account value is exhausted—ensuring you continue receiving income for as long as you live. Few financial tools offer that level of security.

Picture retirement without market anxiety. No worrying about crashes, recessions, or selling investments at a loss to pay your bills. With a zero-percent floor, your account is protected from market downturns, offering stability when you need it most.

Top 10 Positives That Address Common Concerns About Annuities

1. Predictable Income You Can’t Outlive

While markets rise and fall, an annuity can provide reliable income for life, helping reduce the risk of running out of money.

2. Protection From Market Volatility

Annuities can help protect a portion of your retirement savings from market losses, offering stability during uncertain times.

3. Peace of Mind and Reduced Stress

Knowing that part of your income is guaranteed allows many people to feel more confident and relaxed about retirement decisions.

4. Not an All-or-Nothing Decision

Annuities are typically used as one part of a diversified retirement plan, not a replacement for all investments.

5. Less Day-to-Day Management

Once established, annuities often require less ongoing monitoring, reducing the pressure to constantly react to market changes.

6. Strong Insurance Company Oversight

Annuities are issued by insurance companies that are highly regulated and required to maintain financial reserves.

7. Tax-Deferred Growth Potential

Earnings inside an annuity can grow tax-deferred, allowing compounding to work more efficiently over time.

8. Access to Funds When Needed

Many annuities include penalty-free withdrawal options or income features designed for real-life needs.

9. Protection From Emotional Investing

Annuities help reduce the risk of panic selling or overspending early in retirement, which can damage long-term security.

10. Designed for Income, Not Speculation

Annuities aren’t meant to beat the market—they’re designed to provide dependable income and long-term confidence.